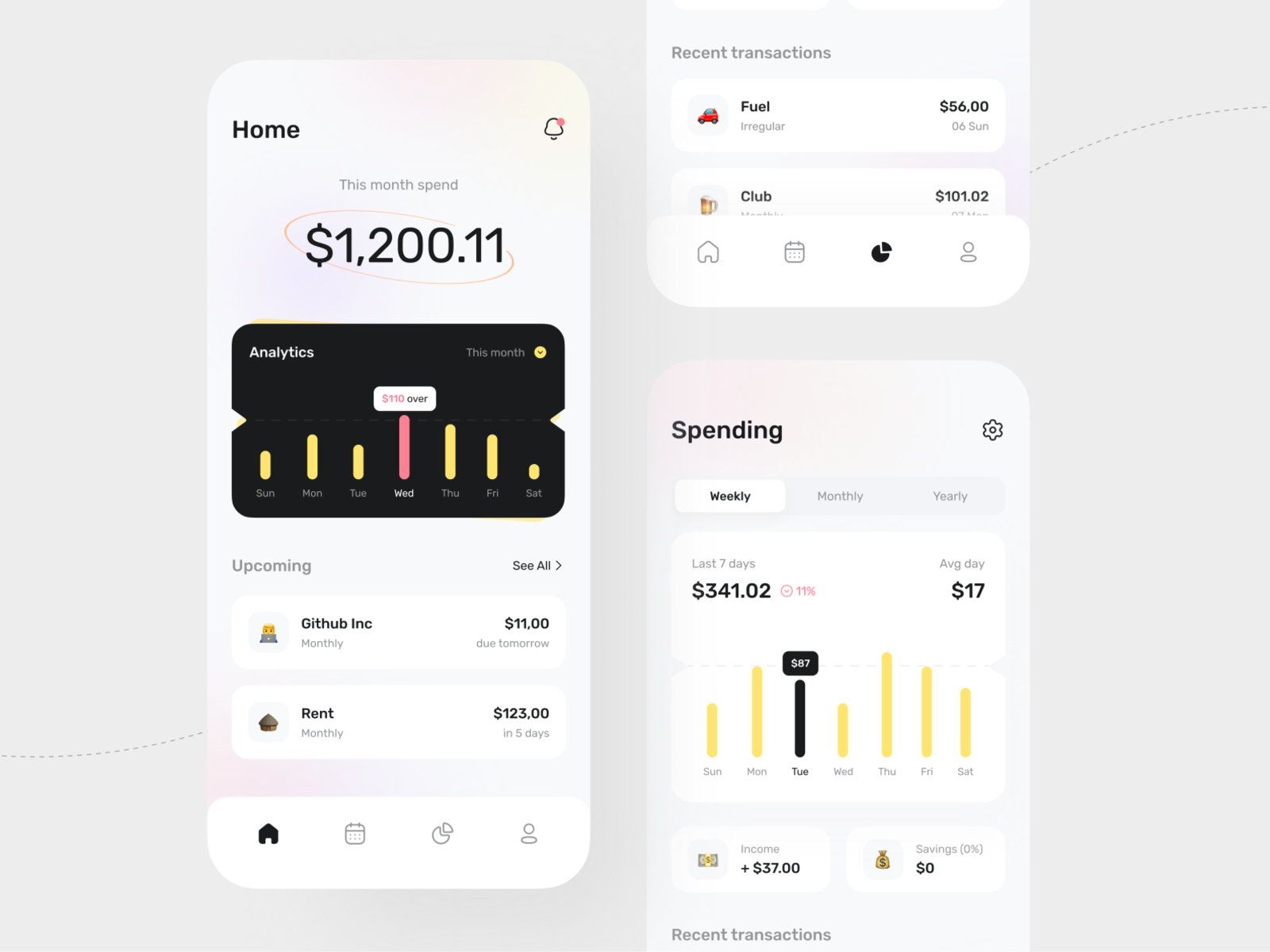

- #APP FOR SPENDING TRACKER FOR FREE#

- #APP FOR SPENDING TRACKER HOW TO#

- #APP FOR SPENDING TRACKER FULL#

PocketGuard scored a spot on our list for its debt payoff tools. Good for users who are working on paying off debt.

#APP FOR SPENDING TRACKER FOR FREE#

Cost: $0 for free version or $7.99 monthly, $34.99 annually, or $79.99 lifetime fee Average app rating: 4.2 Account syncing capabilities: Yes Our verdict PocketGuardĪbout: PocketGuard is a budgeting app that offers bill organizing and budget planning services to over 500,000 users. Mint also offers bill negotiation services for users who are looking to trim their monthly costs.

The app automatically categorizes your transactions and also gives you the opportunity to create your own categories based on your spending habits.

#APP FOR SPENDING TRACKER HOW TO#

The app even offers users personalized insights on how to adjust their budgets to boost savings, pay down debt, and more. Users who budget with Mint can link their bank accounts, credit cards, loans, and investment accounts to better understand their entire financial picture and net worth. Mint ranked highly on our list for its stellar mobile app rating and account integration capabilities. Good for those who want to sync all of their financial accounts. Cost: $0 for free version or $4.99 monthly for Mint Premium Average app rating: 4.5 Account syncing capabilities: Yes Our verdict MintĪbout: Mint is a budgeting app that provides budgeting and bill negotiation services to more than 30 million users.

#APP FOR SPENDING TRACKER FULL#

And if your mortgage is serviced by Rocket Mortgage, you get full access to Rocket Money Premium for free. The good news: Using the negotiation service to cut down on your monthly spending could help you cover the cost of a premium membership. Rocket Money is free to use, although there are optional services, like bill negotiation, that you can opt in to for an extra cost ranging from $3 to $12 monthly. The app also offers bank-level security with 256-bit encryption to keep your personal data safe.

Rocket Money allows users to create a budget that automatically monitors spending, separates transactions into spending categories, sends notifications about upcoming charges or a low balance, and more. Good for those who are looking to cut down on their monthly costs. Cost: $0 or $3–$12 per month for premium version Average app rating: 4.4 Account syncing capabilities: Yes Our verdict Rocket MoneyĪbout: Formerly known as Truebill, Rocket Money is a budgeting app that serves more than 3.4 million members worldwide and offers budgeting tools, bill negotiation services, and more. Zeta has an average mobile app rating of 4.4 and also offers two-factor authentication and data encryption to keep your data extra safe. The app offers both personal and joint accounts that allow you to pay bills, save for goals, and track shared expenses, and even offers in-app messaging to communicate with your partner or other members of your family about your budget. Zeta offers a number of features that make it an ideal app for budgeting with others in your household. Good for couples and families who want to merge their finances. Annual cost: $0 Average app rating: 4.4 Account syncing capabilities: Yes Our verdict ZetaĪbout: Zeta is a budgeting app that caters specifically to couples and families hoping to track their expenses together. (Note: Fees and account features in this list are up to date as of April 19, 2023, but are subject to change.) 1.

0 kommentar(er)

0 kommentar(er)